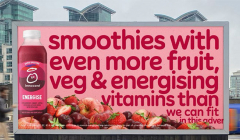

Innocent campaign is jam-packed with goodness

Neverland helps bring to life the amount of fruit, veg and vitamins in Innocent smoothies and juices

How inflation on consumer spending will impact consumer behaviour

Like all economies, the UK economy is prone to pressure from global events. Even before the ever-growing threat of the Ukrainian war and the cost-of-living crisis, the IMF cut its global growth forecasts for 2022, impacted by Omicron, blocked and interrupted supply chains, and China’s property bust. In these wholly unpredictable times, it’s fair to say that nothing about the past can prepare us for the future.

However, there are identifiable underlying themes. Through researching, collating, and analysing a wide variety of sources on the impact of inflation on consumer spending, consumer behaviour can be explored through four key trends that will shape the rest of 2022 and beyond.

We’ve been accustomed to low inflation and interest rates for a generation. The last time inflation exceeded 5% was in 1992 – so everyone of working age in the population, including business executives and lawmakers, has never seen a high-inflation economy. Driven by the rise in fuel price, supply chain issues, and increased prices on staples like food, consumer inflation rose by 9% in the 12 months to April, up from 7% in March and The Bank of England has warned that UK inflation could reach 10% in the last three months of 2022.

Inflation will affect a large portion of the population, and it will not be distributed evenly. Consumer budgets will be squeezed; we will see an increase in price-driven discounting, promotions and brand switching. These conditions could exacerbate existing divides, with large segments of the population experiencing economic stress compared to a wealthy cosmopolitan elite.

But what does this mean for advertisers? Unfortunately, wage growth will fall short of inflation, leaving people in a bind. This will differ depending on age, location and occupation and will most likely influence response levels. After lockdown, people will look for credit to supplement their income or lifestyle, so expect increased use of credit if interest rates remain low, meaning consumer debt could rise.

Many people want a release; they’ve had a tough time, and it’s getting tougher. This year will also see a return to hedonism. Many people, particularly younger ones, will seek low-cost live entertainment. Expect a return to festivals and collective group entertainment this summer, albeit on a budget.

Deloitte’s report of Retail Trends for 2021 found that only 57% of people in the UK feel safe going into physical stores. At-home shopping is around 25% of all retail expenditure, varying significantly by sector, location and consumer, but the convenience of at-home shopping will only grow. As hybrid and remote working continue, many brands will benefit from a more localised, omnichannel approach to retail.

Adding to the mix is the expansion of Facebook Shopping, the likely introduction of Facebook Pay, and the rapid rise of ecommerce on short-form video (TikTok and Snapchat). This growth is reflective of the ways people are consuming content – video has become a key news format. This means there’s plenty of innovation in video ad formats – interactive overlays, shoppable video and new social formats. Retail brands will need to develop an always-on, at-home communications strategy that regularly tests multiple emerging channels and formats.

This means that future communications strategies will be more complex, data-driven and multi-channel. We need to understand where people make decisions by widening the scope and targeting the whole shopper journey. As consumers shift to a digital-based home life, physical shopping is becoming a leisure activity.

Many older audiences will return to spending more quickly; many have guaranteed incomes and have become used to ecommerce during the lockdowns. There are huge opportunities in effectively engaging older audiences – brands should better understand how to communicate with specific older groups and ensure that advertising reflects their aspirations.

As the elderly population grows, age diversity becomes important. OFCOM data shows that consumers over 65 years old are digitally engaged: 77% use the internet at home, 55% use a smartphone, and 59% of internet users have a social media profile. The older population represent critical target audiences for brands and holds significant purchasing power.

Although the lockdown has altered media behaviour, linear channels continue to reach this group. For brands to unlock the full potential of older audiences, they need to better identify which messages appeal to specific generations.

We are entering an environment in which trust in institutions has been shattered. This has been exacerbated by below-standard behaviour by those ostensibly in charge and a broader issue of trust in news sources fuelled by the pandemic. The country has many fissures, not only north-south but also by age, life circumstance, country and level of education, which is exacerbated further by inflation.

When developing new strategies, brands must tread carefully and be mindful of how they communicate, especially via social media. We are entering a world where brands will be scrutinised and called out if their communications are tone-deaf – they will need to be sensitive, and one-to-many communication may not always be appropriate.

Brands need to tailor communications to specific audiences and understand the nuances that divide the country. They will need to communicate sympathetically and better understand the needs of specific groups in an economic downturn. In a divided nation, one message will not fit all.

Verity Brown is Managing Director at The Specialist Works. She joined The Specialist Works in 2015 to lead the planning team. As Managing Partner she successfully bought in high-value new business including Frasers Group, Ovo Energy, Toolstation, Hastings Direct and Autotrader.

Looks like you need to create a Creativebrief account to perform this action.

Create account Sign inLooks like you need to create a Creativebrief account to perform this action.

Create account Sign in