Virgin Media O2 launches summer online safety campaign

Virgin Media O2 and Internet Matters spotlight the importance of having conversations about online safety and starting them early

The latest IPA Bellwether Report reveals increased marketing budgets and an increase of confidence amongst marketers.

Headline findings from the latest IPA Bellwether Report show marketing budgets to be up once again hitting a one-year high. While this means that marketing budgets are at their strongest since Q2 2022; the mood is one of ‘cautious optimism’. The ongoing cost of living crisis and turbulent economic climate continue to bring uncertainty to the industry.

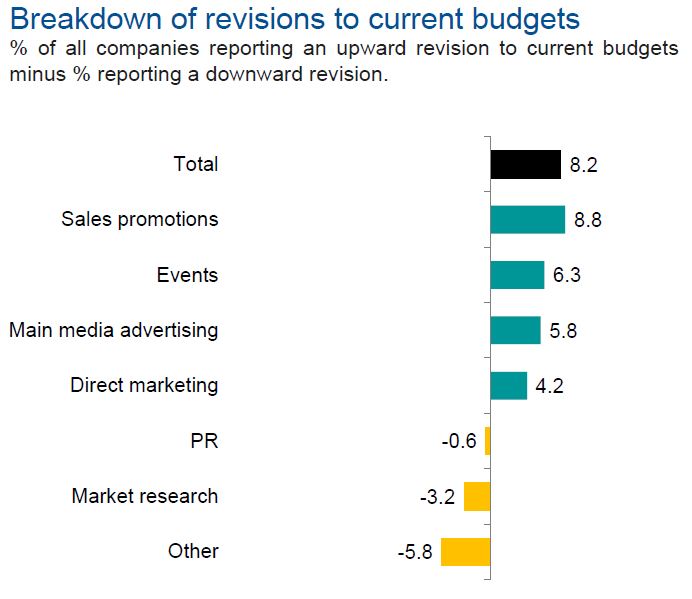

The Q1 2023 IPA Bellwether Report published today (Thursday 20th April) reports strong market growth despite a challenging global and domestic economic environment. Data reveals that the net balance of firms registering upward revisions to their marketing budgets in Q1 2023 is +8.2%. This is considerably higher than the +2.2% recorded in Q4 2022. The report found that 21.1% of the firms surveyed expanded their budgets, while 12.9% registered budget cuts and 66% recorded no change in spending.

"The latest Bellwether survey once again highlights the resilience of UK businesses who have endured both a pandemic and a period of plunging consumer confidence and multi-decade high inflation. Total marketing budget growth broadened out during the opening quarter, showing that more companies are tapping into their marketing resources to help them successfully navigate through economic turbulence." explains Joe Hayes, Senior Economist at S&P Global Market Intelligence and author of the Bellwether Report.

Growth by category in Q1 2023 found main media marketing, which includes online advertising activity and budgets for big-ticket campaigns on TV, recorded its strongest expansion in spending since Q1 2022 growing +5.8%, from +4.4%. Perhaps indicative of the importance of brand building and consumer awareness in times of recession.

A main media marketing breakdown in the report showed strong growth in online (+10.5%, from +6.3%) and video (+7.9%, from +13.7%), and a renewed upturn in audio (+1.7%, from 0.0%). However within this category published brands (-1.9%, from -3.9%) and out-of-home (-12.4%, from -8.8%) did not see the same strong uptick.

Sales promotion budgets saw significant expansion in Q1 as organisations create deals and promotions to support consumers through the cost of living crisis. These budgets saw an increase of +8.8%, from -4.0%, rising at the strongest pace in nearly two decades as customers turn to brands and give loyalty to those that can offer the best value packages.

Elsewhere events and direct marketing efforts continued to grow while all other categories recorded budget cuts. A net balance of -0.6% of firms cut their PR budgets, while a modest reduction was also seen in market research spending.

The report signalled a sense of optimism amongst panellists regarding their own company's financial prospects as 7.0% of firms were optimistic towards their business outlook up significantly from -17.2% previously. However at industry level, many remain pessimistic.

Yet while Bellwether panel remembers are cautious in their approach to the financial climate, a proportion had grown more confident. With 22.8% of companies downbeat in their assessment compared to 41.8% previously, the numbers of optimists seemingly grow meaning that this report signals the weakest degree of negativity in a year.

“This is a positive start to the financial year for marketing budgets, all things considered, The overall increase in confidence from UK companies regarding their financial prospects is being reflected in their marketing budget decision making.” commented Paul Bainsfair, IPA Director General.

Budget plans for 2023/24 are indicative of this cautiously optimistic approach. Expectations towards marketing budgets for the new financial year were strongly positive in line with previous estimations. More than a third (36.6%) of respondents foresee greater total marketing spend in real terms in the year ahead, compared with 16.9% anticipating cuts.

Category growth is set to be expected in face-to-face marketing activities such as events which is predicted to see growth of +14.5%. Where post-pandemic the events industry has proved the value of human interaction, maximising on the benefits of face-to-face connection holds strong appeal for both brands and consumers.

Main media budgets and sales promotions budgets are also set to rise showing that brands are settling into a cost-of-living crisis with no near end in sight.

“As the cost-of-living crisis continues, it is understandable for companies to offer sales promotions to help their customers’ tightened purse strings. To ensure brand loyalty isn’t eroded and to protect the long-term health of their brands, however, such activity must be coupled with investment in longer-term brand-building media.” added Bainsfair.

Beyond 2024 the report forecasts adspend to improve. S&P Global’s forecast for the UK economy has been modestly upgraded, with GDP in 2023 expected to decline by -0.2%, instead of the -0.8% anticipated in the last Bellwether Report.

However, households continue to face shrinking purchasing power due to high inflation and borrowing costs, which the report suggests is set to weigh heavily on the economy. In response to this Bellwether has issued a revised forecast, which predicts a small decline of -0.9% (vs. -0.3% previously) in adspend this year, a marginal improvement in adspend next year of 0.5%, before expected growth to 1.6%, 2.0% and 2.2% in 2025, 2026 and 2027 respectively.

For marketers and decision-makers, the report signifies a clear small but stable growth opportunity. While proceeding with caution is advised, the industry holds a strong position in its ability to weather economic headwinds as marketing efforts prove vital in helping both brands and consumers through the ongoing cost of living crisis.

Looks like you need to create a Creativebrief account to perform this action.

Create account Sign inLooks like you need to create a Creativebrief account to perform this action.

Create account Sign in