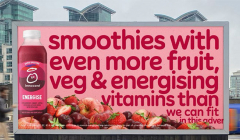

Innocent campaign is jam-packed with goodness

Neverland helps bring to life the amount of fruit, veg and vitamins in Innocent smoothies and juices

Q4 IPA Bellwether Report finds that despite the looming recession businesses are expanding marketing budgets

‘Don’t go dark’ is the advice that brands appear to be following as the UK recession looms, where in response to economic turmoil consumers coms are a priority. The Q4 2022 IPA Bellwether Report reveals that while the UK economy was widely expected to enter a technical recession at the end of the year, marketing budgets were on the increase.

Like in past recessions business response is polarised as the report found that while around one-fifth of survey respondents upwardly revised their total marketing spending in Q4, 18% registered budget cuts. Spend by media category saw minimal change throughout the quarter and events maintained steady growth (net balance of +5.7%, vs. +4.5% previously) reflective of the restoration of pre-pandemic equilibrium.

Preliminary data from the report suggests a positive outlook for marketing budgets in the 2023/24 financial year. Many companies (39.5%) expect total marketing budgets to be higher while just 15.3% anticipate spending cuts. This led to a strongly positive net balance of +24.2% which should instil some cautious optimism in UK marketers.

Budget growth is strong across all categories and events continue to maintain the strongest growth (+18.0%) as the benefits of face-to-face meetings hold strong. Elsewhere, firms were also positive towards sales promotions (+7.9%), despite margin pressures to lean into the needs of consumers and hope to increase loyalty amid the cost of living crisis.

“We can see that the companies that can are holding their nerve and continuing to invest in marketing through the downturn, with supporting anecdotal evidence from the report also revealing that a lot of companies who are concerned about losing market share to competitors have either maintained or increased their spend accordingly. This indicates that marketing is being used both defensively and offensively.” says Paul Bainsfair, IPA Director General.

Yet while the future may seem optimistic for marketing, business sentiment among Bellwether panellists during Q4 of 2022 was downbeat. The year of high inflation, increased interest rates and low consumer confidence leading to a UK recession will see marketers continue to face challenges going forward.

Looking at the wider business landscape beyond marketing, 41.8% felt that their financial prospects within their specific industry had worsened when compared to the three months prior. Just 8.7% of companies were optimistic about the outlook for their specific sectors. While companies push budget into marketing efforts, overall businesses are suffering in such an unstable economy.

The report suggests that ad spend may weaken in 2023 but growth is set to resume next year. Authors of the report expect GDP to shrink in 2023 by 0.8% as household incomes are squeezed by inflation. This is set to have a knock-on effect across the economy which will endure rising interest rates and weak consumer confidence creating an increasingly challenging environment for both businesses and consumers. The prospect of recession remains looming.

That said the report predicts a short and shallow recession in the UK, leading ad spend to decline by a modest 0.3% in 2023 and growth to follow in the years following. While the economic landscape is turbulent, advertising services maintain a strong position due to the industries’ ability to help consumers and businesses alike weather the storm.

Looks like you need to create a Creativebrief account to perform this action.

Create account Sign inLooks like you need to create a Creativebrief account to perform this action.

Create account Sign in